When we compare e-wallets or payment gateways to payment with card or cash, we often evaluate the former as more convenient. That might be a bit of an overstatement, really. Holding your credit card in front of a card reader does not exactly sound like much work, does it?

No, what really makes modern digital payment methods so powerful is their feature-richness and flexibility. For example, you can simply conduct cross-border payments or transfer tiny amounts of money with digital payment methods. And even if you are bound to our own four walls (for some reason), you can pay for goods and commodities with just a few clicks.

But payment does not equal payment. Behind the scenes of your checkout page, in the technical profundities of the software, it makes a huge difference whether the payment happens via an e-wallet balance or a digital bank or credit card transfer, facilitated by a payment gateway.

Payment Gateways vs. E-Wallets? Not Quite!

However, make no mistake and don’t take “Payment gateways or e-wallets” literally. The two are not exact opposites: You need PGs to process a transaction no matter what. The real question is: How exactly does using e-wallets vs. regular payment providers influence the payment process, especially regarding user experience?

To answer it, we will contrast the common traits, advantages and disadvantages of e-wallets and payment gateways. This will help you if you have to decide on a payment flow fitting your business model. Will a payment gateway connecting your checkout flow to external PSPs suffice? Or do you want your customers to have their own e-wallets with all the benefits (and pitfalls), that come with them? Let’s see…

Payment Gateway-Only Solutions

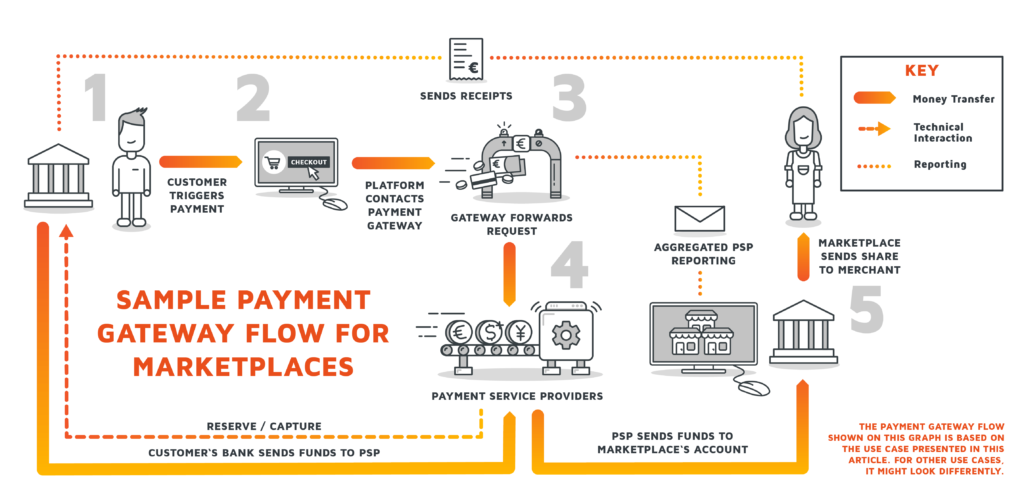

In a nutshell, payment gateways are software solutions that facilitate and provide access to payment services. In that role, they can be integrated with multiple payment service providers.

During checkout, the customer chooses how to pay. Once the checkout process is complete, the payment gateway exchanges the payment information between the customer and the merchant. In doing so, it must follow specific security standards and comply with the regulations of local financial authorities.

How a payment gateway is connected to an e-commerce platform can vary. It’s possible that a platform redirects customers to external payment pages which are hosted offsite by the payment gateway. Alternatively, it allows interaction with the payment gateway from its own, tightly integrated payment page. On the other hand, you have self-hosted (and self-built) payment gateways.

Advantages of Payment Gateway-only Solutions

Less Regulation

Regulations regarding Payment Gateways are not as strict as those for e-wallet systems. While those processing credit cards have to adhere to the Payment Card Industry Data Security Standard (PCI DSS) for example, and those in Europe require a PSD2 PISP authorization, there are one big regulatory hurdle Payment Gateways typically don’t have to take: they don’t have to obtain an e-money license.

Tighter Security

As they process monetary transactions, Payment Gateways store and exchange personal data. Such data is easily misused when falling in the wrong hands. However, Payment Gateways have to collect significantly less data than e-wallet systems to function properly. Ultimately, that makes it much easier for Payment Gateway owners to guarantee data safety.

Less Development Effort

Developing and integrating e-wallets is a complex endeavor. That’s mainly because, besides payment processing, e-wallets also need top-up and withdrawal functionalities, e-money balance management, KYC processes for buyers and so on, let alone the additional UI to allow customers to interact with their e-wallets (a customer service area).

Sticking with payment gateways means that you just need to integrate at least one payment service provider. You can update the system later with additional providers, oftentimes with little effort. You don’t need to care much about the buyers’ side, but more about the sellers’ onboarding and management.

Disadvantages of Payment Gateway-only Solutions

Restricted Refunding Options

Without an e-wallet system, you can only refund money back to the user’s original source of payment (credit card, bank account…).

As a merchant or marketplace owner, this means you would release the money back, instead of keeping them in the wallet and motivating the customer to use it on your e-commerce platform. Working around this requires complex efforts, such as giving out the refund money in the shape of vouchers.

Higher Transaction Fees

The sole purpose of payment gateways is to move money. And this typically incurs a transaction fee often consisting of a fixed amount or a percentage of the transaction amount. Depending on volume and ticket size, this sums up quickly. On the other hand, with a wallet-based system, you can save fees e.g. by refunding customers, not to their payment source, but to their e-money account (see above), so that funds only move between virtual accounts but not in the real world.

No Additional Services

Payment gateway-based payments are fairly straightforward. From “checkout” to “pay-off”, nothing fancy. But sometimes it is the advanced feature set that makes your customers smile, like loyalty points, free-of-charge P2P payments or gift cards. E-wallet-based systems can handle such features directly, without the need for additional external systems to be implemented.

Payment with E-Wallets

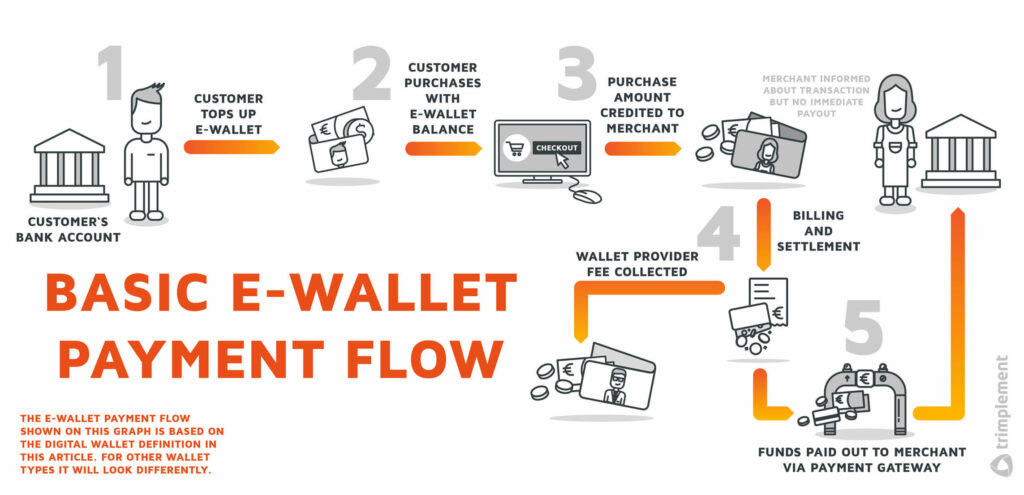

The most basic definition of e-wallet, often also called a digital wallet or cyberwallet, is that of a virtual equivalent of a physical wallet. As such, an e-wallet acts as a subledger, a container for electronic money and virtual accounts within a virtual account management system. It can also store the user’s payment instrument details in a secure manner.

While we will stick to this basic definition, we are well aware that it falls a bit short. Neither does it address the complexities of e-wallets nor does it take the different types of e-wallets into account.

For our purposes, we will talk about the advantages and disadvantages of digital wallets processing e-money. That means we exclude crypto and mobile point-of-sale transactions for the time being.

Advantages of E-Wallets

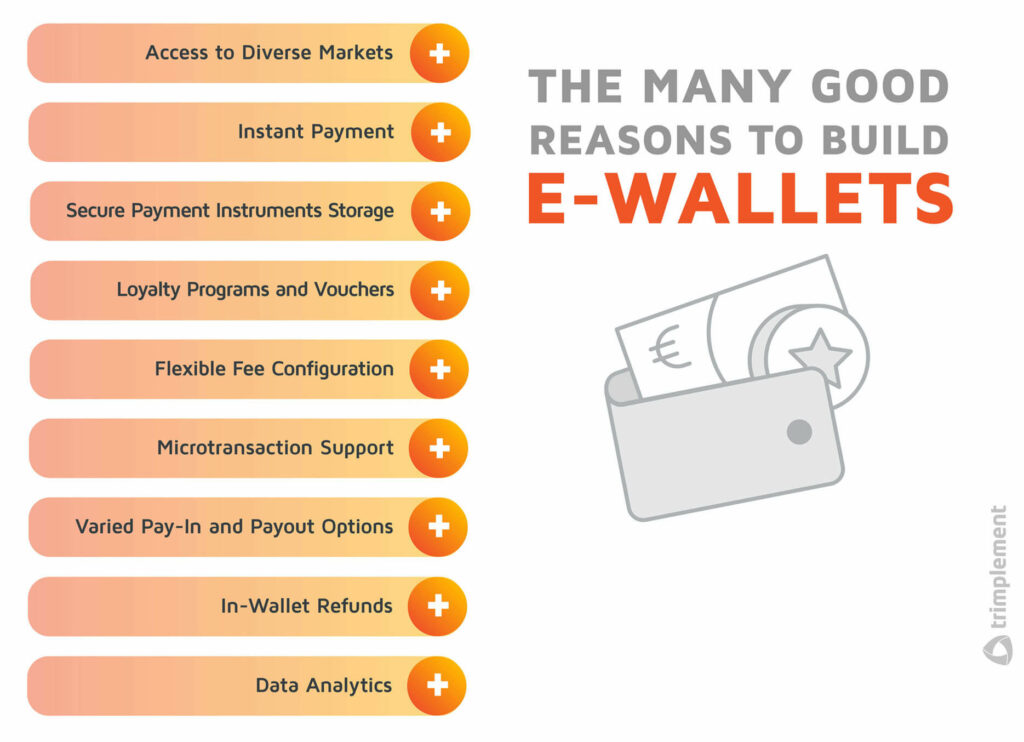

Access to Diverse, International Markets

E-wallets are essentially a payment method. So, supporting them brings in new customer groups, who prefer this method. This might open your services up to new demographics. If your business wants to establish itself in developing or emerging economies, e-wallet-based payment systems can act as a door opener. Especially in rural areas and among unbanked demographics, mobile and electronic wallet technology is prevalent. Those wallets can be topped up in stores or with prepaid cards, giving users the opportunity to transfer and accept funds without the need of having a bank account.

Keep in mind though, that electronic wallets are typically subject to regulations. And those regulations might differ from country to country.

Instant Payment

This advantage is especially important for merchants. Electronic wallets propel payments through the simple exchange of data and e-money.

Typically, that amounts to instant payment transactions for customers, if the wallet contains enough e-money balance. For merchants, it’s a little more complicated: They receive their funds immediately and will see that the e-money is booked into their account. But the settlement with actual money may take some time. Nevertheless, many merchants appreciate the higher degree of financial planning certainty e-wallet-based payments provide.

Secure Payment Instruments Storage

Users expect payment to process securely. Indeed, it’s this need, that is behind the establishment of e-wallet technology in the first place. When PayPal, the very first e-wallets, was launched in 1998 it provided a counterpunch to the flood of shady e-commerce merchants on the young world wide web, all of which wanted to get a hold of customers’ credit card data. PayPal presented a securer way to pay, as the payment instrument data remained with the wallet provider.

Today, this still adds to the attractiveness of e-wallets. Digital Wallet software privately stores user information, without merchants getting a hold of what’s not meant for their eyes. At the same time, it’s more convenient for users. Instead of entering the payment information for each new platform, they shop at, users can rely on e-wallets to automatically use the stored payment instruments. This makes for a better user experience and prevents mid-purchase cart abandonment.

Loyalty Programs and Vouchers

Where payment gateways and PSPs are nothing more than simple transaction facilitators, digital wallet systems can really shine in terms of additional features. For example, digital wallets can not only contain e-money, but also loyalty points and other incentive tokens.

They can directly process gift cards and discount vouchers, too. Furthermore, you can permit users to transfer e-money within the system, constructing P2P lending or trading features. And that’s only the tip of the iceberg. Imagine what you could do when you introduce tokenized assets and cryptocurrencies into your e-wallet system.

Flexible Fee Configuration

E-wallets go easy on additional expenses. First off, you as the platform owner don’t have to pay fees for internal e-money transactions. That’s because such transactions run entirely within the closed online wallet system. No money moves between banks and no PSPs are involved there.

At the same time, it’s perfectly possible for you to collect fees from merchants on your platform or to charge for P2P transactions.

Microtransaction Support

If the accounting module is built up accordingly, e-wallets can easily handle microtransactions, like fractions of the smallest monetary unit (e.g. 0.1 cents). The advantage detailed in the former paragraph plays a role in this as well: In payment gateways, transaction fees and processing costs usually render microtransactions too expensive.

Varied Pay-In and Payout Options

Platform owners can configure their e-wallets to support different ways to conduct deposits or withdrawals – from top-up via standard credit card or bank transfer to different regionally available alternative payment options. What’s more, e-wallets can also be set up to work in cross-border contexts with multiple currencies. Take the case of remittances, for example, with someone depositing money in one currency and their family abroad using or withdrawing it in another currency.

In-Wallet Refunds

In case of refunds, the money can go directly back to the e-wallet instead of the original source of payment. For merchants and platform providers, this helps to keep users on the platform. The money stays within your e-commerce system. This motivates customers to spend it there again.

Data Analytics

E-wallet payments produce data. Customer data is the most obvious, but also payment history data is stored within an e-wallet. All those data sets are worthwhile reference points for analysis. This allows platform owners to make conclusions on how users use their services, helping to purposefully improve the user experience in future updates. In e-wallets, both the e-commerce platform as well as the e-wallet provider owns the customer data, so it’s easy to compile specific reports for merchants, of course only giving away what is allowed due to data protection laws.

Disadvantages of E-wallets

Stricter Regulations

E-wallets holding and processing fiat currencies are subject to a greater number of regulatory requirements than payment gateways. For example, e-wallet systems may not launch without the platform owner having obtained an e-money license. Users need to go through KYC/AMT/CFT procedures and limits have to come into effect according to their verification status.

Higher Security Efforts

As e-wallets store sensitive customer information directly, as opposed to external PSPs, it’s even more important to ensure data protection. There are a ton of important factors to consider here: Encryption and payment instrument tokenization is only the tip of the iceberg. E-wallet providers also have to comply with regulatory rule sets like PCI DSS. They have to provide strong customer authentication to their customers. And finally, any system is only as secure as its code – make sure to have it put down by a software team with profound secure coding and security awareness training.

For a detailed example of what a payment system with e-wallet support can look like, have a look at our Delivery Hero case study.

E-Wallets or Payment Gateways? Combine the Two!

We have seen that payment gateways and e-wallets present very different strengths and weaknesses. But it’s not like you have to fully commit to one or the other. For owners of an online marketplace or a service platform, it’s beneficial to have their own payment system, including a custom-made payment gateway.

However, you can design your online payment system to be e-wallet-based. This way, you can offer your customers more features than simple payment processing (like loyalty points for example). Also, you could differentiate between guest accounts (for pure payment processing) and fully registered customers. The latter have a wallet account and thus extra functionalities at their disposal.

For a detailed example of what a payment system with e-wallet support can look like, have a look at our Delivery Hero case study.

Conclusion: One or Double?

E-money wallets and payment gateways are no mutual exclusives. To combine both systems, you need to meet regulatory requirements: Having an e-money license is just one of them. On the technical side, it surely can get very complex. And it’s where we can help, in several ways:

- Use CoreWallet, our scalable software foundation to build your own e-wallet-based payment solution

- Rely on our software development team, bringing in years of experience in secure coding and financial software development, to support you in building your own payment gateway

- Ask us to optimize your payment infrastructure and help you with selecting the optimum 3rd party gateways and contracts

Whichever option you choose, we get your business ready for the age of digital payment. No ifs, no buts, no ors.